Recent Posts

categories

Archives

- Tips to Lower your Electric BillPosted: 5 years ago

- 5 Easy Home Improvement Projects & Upgrades For the WinterPosted: 5 years ago

- Benefits to buying in the winterPosted: 5 years ago

- Cash In with a Cash-Out RefinancePosted: 5 years ago

- Mortgage MythsPosted: 5 years ago

- Q&A: All About Flooring — Hardwood, Carpeting, Tiling, LaminatePosted: 5 years ago

- Tip: 3 Foolproof Social Media Marketing TipsPosted: 6 years ago

- Tips for Hosting a Stress-Free Holiday DinnerPosted: 6 years ago

- Is a Mortgage Refinance Right for You?Posted: 6 years ago

- Check Your Disaster Supplies KitPosted: 6 years ago

- Create an Early Holiday Shopping BudgetPosted: 6 years ago

- 9 Ways to Make Moving Day EasierPosted: 6 years ago

- July 2018 Market Update – Twins Cities RegionPosted: 6 years ago

- Fall Homeowners ChecklistPosted: 6 years ago

- Scam Alert: Spoofed IRS Phone NumbersPosted: 6 years ago

- 15 Years of First Class MortgagePosted: 6 years ago

- How to buy a second homePosted: 6 years ago

- Q&A: Lawn Watering SecretsPosted: 6 years ago

- Troubleshoot Your Air ConditioningPosted: 6 years ago

- Your Mortgage, What to Expect: Clear To ClosePosted: 6 years ago

- Twins Cities Region Monthly Indicators – APRIL 2018Posted: 6 years ago

- Your Mortgage, What to Expect: UnderwritingPosted: 6 years ago

- Your Mortgage, What To Expect: Property AppraisalPosted: 6 years ago

- 3 Tips to Improve your Credit Score and Score a Lower Interest RatePosted: 6 years ago

- Changing Interest Rates Have A High Impact On Purchasing PowerPosted: 6 years ago

- The Myth of Multiple Mortgage Credit InquiriesPosted: 6 years ago

- Things to do BEFORE you buy a home.Posted: 6 years ago

- March Tech Tip: Pack Smarter With PackPointPosted: 6 years ago

- 4 Ways to Pay Off Your Mortgage EarlyPosted: 6 years ago

- Clean House in a HurryPosted: 6 years ago

- Your Mortgage, What To Expect: Document ReviewPosted: 7 years ago

- Chill Winter Utility BillsPosted: 7 years ago

- Six Tips to Help Your Home Sell This FallPosted: 7 years ago

- 4 Things to Know About Closing CostsPosted: 7 years ago

- Understanding Your Credit ScorePosted: 7 years ago

- Equifax Data Breach: What should you do now?Posted: 7 years ago

- Should You Refinance Your FHA to a Conventional Loan?Posted: 7 years ago

- 6 Ways to Save on Paint ProjectsPosted: 7 years ago

- Q&A: Mortgage InsurancePosted: 7 years ago

- How to Keep Your House Cool this SummerPosted: 7 years ago

- Mortgage Education: “What’s the Point?”Posted: 7 years ago

- Q&A: Spotting a Spoof SitePosted: 7 years ago

- Moving ChecklistPosted: 7 years ago

- Squash Marital Money SquabblesPosted: 7 years ago

- April 2017: Twin Cities Real Estate Market UpdatePosted: 7 years ago

- Your Spring Guide to Home StagingPosted: 7 years ago

- March 2017: Twin Cities Real Estate Market UpdatePosted: 7 years ago

- Don’t be a Victim — Four Ways Protect Yourself from Refinance ScamsPosted: 7 years ago

- Local Market Update: Minneapolis Area Association of RealtorsPosted: 7 years ago

- First-Time Homebuyers: Where to startPosted: 7 years ago

- Dear First Class Mortgage:Posted: 7 years ago

- First Class Mortgage. Our Expertise, Your Peace of Mind.Posted: 8 years ago

30

April

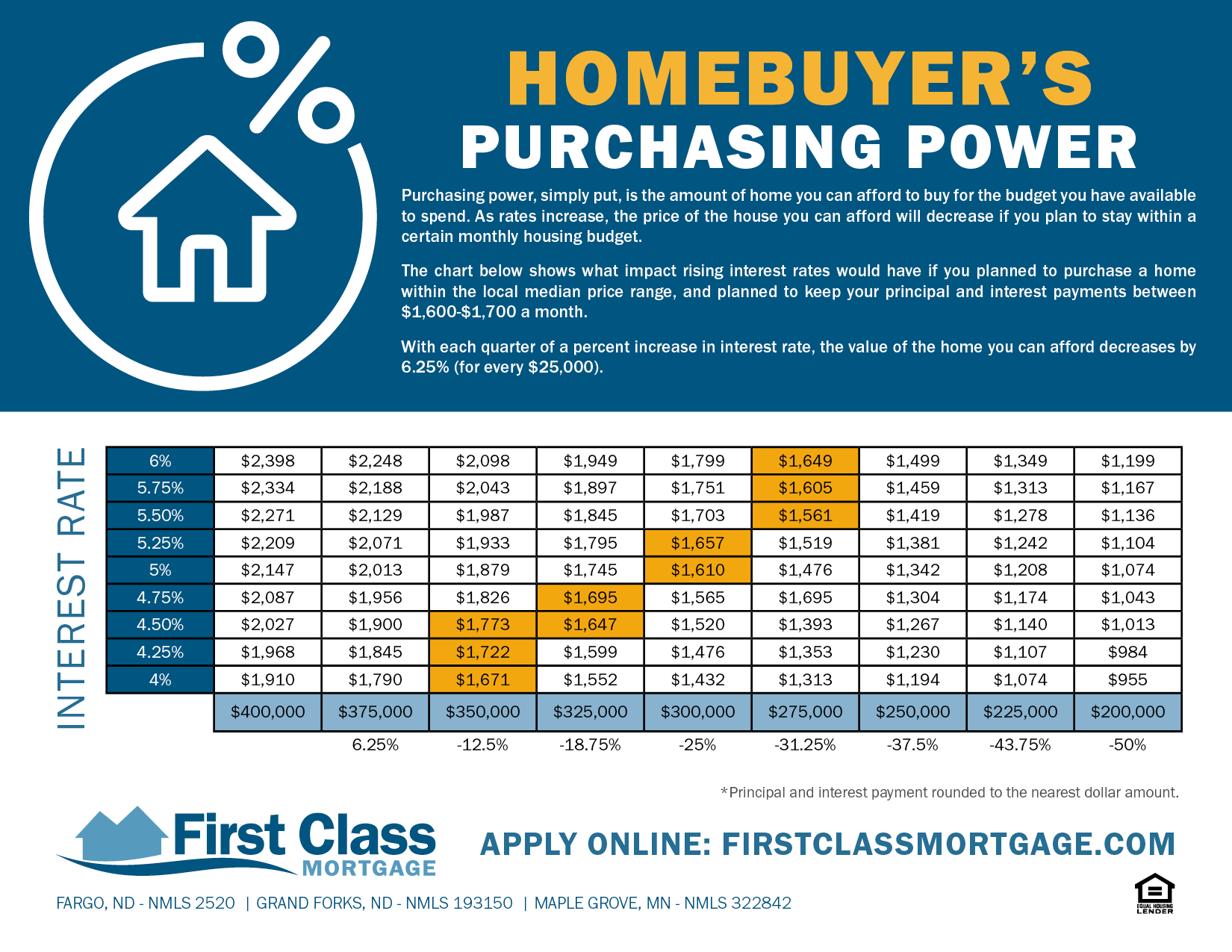

Changing Interest Rates Have A High Impact On Purchasing Power

Posted byPurchasing power, simply put, is the amount of home you can afford to buy with the budget you have available to spend. As rates increase, the price of the house you can afford will decrease if you plan to stay within a particular monthly housing budget.

The chart below shows what impact rising interest rates would have if you planned to purchase a home within the local median price range, and intended to keep your principal and interest payments between $1,600-$1,700 a month.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 6.25% (for every $25,000). DOWNLOAD PRINTABLE FILE

30

May

Squash Marital Money Squabbles

Posted byAccording to a Money Magazine poll of married couples over age 25 with household incomes of $50,000 or more, 70 percent of couples argue about money more than other topics. Fortunately, there are ways to avoid common trip wires and help defuse money arguments before they blow up.

Money talks. Personalities, childhood experiences, spending and lifestyle habits all create differences in attitudes and behavior with money. Discuss these differences openly to deepen understanding.

No secrets. The most common money secrets among couples include hiding cash, minor purchases, and bills, as well as setting up secret bank accounts or credit cards. Keeping secrets creates stress. Maintain transparency to keep your relationship healthy.

Budget building. Budgeting — and sticking to the budget — is one of the best ways to prevent arguments and avoid too much debt. Since an agreed-upon budget is an objective measurement, budgeting can help establish a financial foundation, foster teamwork, promote living within your means and create goals. Ease the process with budgeting tools and apps.

Make allowances. Like budgeting, joint bank accounts foster openness and teamwork. But sharing every penny, especially when you have different spending habits, can cause problems. Budgeting a little every month for each person to spend on “whatever” promotes a sense of personal freedom.

Manage together. Sharing the responsibility, rather than one partner handling the finances, helps avoid misunderstandings and mistrust. Moreover, if an illness or death occurs in a couple, the remaining partner is acutely aware of how to manage the household finances.

Get advice. The perspective of a professional financial advisor or coach can help you set realistic goals, educate on options, promote collaboration, diffuse potentially tense conversations and often save you money in the long run.

Everyone has a unique way of looking at money, so remember to see discussions as an ongoing opportunity to deepen your perspective about each other and your relationship, not as an opportunity to prove a point.

Sources: Reader’s Digest, Psychology Today

Some of the material contained in this newsletter has been prepared by an independent third-party provider. The material provided is for informational and educational purposes only and should not be construed as investment, financial, real estate and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

03

February

Dear First Class Mortgage:

Posted by

Dear First Class Mortgage,

“What does a good REALTOR® look like?”

-Merry of Maple Grove, MN

Hi Merry,

That is an excellent question! Here are some things to keep in mind and look for when finding your REALTOR®:

They should…

• Effectively communicate with you and adapt to what communication style you prefer: text messages, email, phone, or good ol’ face-to-face interaction

• Listen to what you want and actively search based on your needs and desires

• Confirm they’re on the right track with the house hunt, and make adjustments when necessary

• Understand your time frame and why you are purchasing and/or selling

• List your home with an appropriate price

• Utilize all marketing tools necessary to make your home stand out when listing: social media, top-notch photography, posting on Multiple Listing Services (MLS), etc.

• Confirm that an interested buyer is pre-approved

• Negotiate to get you the best offer

And, verify that they are…

• Organized and detail oriented

• Local experts- they know the area inside and out

• Willing to provide a list of their clients as references

First Class Mortgage has had the pleasure of working with excellent local real estate agents. We would love to refer one of them to you! Call or email us today for more information.

Remember that it is always a good idea to get pre-approved prior to starting the house hunt. Apply today!

25

January

First Class Mortgage. Our Expertise, Your Peace of Mind.

Posted by Welcome! We launched our new website and blog!

Welcome! We launched our new website and blog!

For fourteen years, First Class Mortgage’s goal has remained simple — deliver an exceptional mortgage experience. We thank our customers for joining us on this awesome journey and we hope that you will continue to be a part of our story.”

This blog is an exciting new element to our multimedia offerings. Its purpose is to answer your top mortgage questions and provide resources for your personal wealth. We will share company news, community information and breaking mortgage news.

But, we don’t want a static blog. We will leverage social technologies to engage in two-way communication with our customers. From there we will take your feedback into consideration as we create new content, tools, and resources.

Please contact us to let us know what you think of our new website and blog! All comments and feedback are welcome. We would love your suggestions for new information or topics. What do you want to learn more about? Is there something we are missing that you would like to see? What other questions do you have?

We look forward to growing with you as we embark on this new journey.

Thanks for stopping by!