Recent Posts

categories

Archives

- Tips to Lower your Electric BillPosted: 5 years ago

- 5 Easy Home Improvement Projects & Upgrades For the WinterPosted: 5 years ago

- Benefits to buying in the winterPosted: 5 years ago

- Cash In with a Cash-Out RefinancePosted: 5 years ago

- Mortgage MythsPosted: 5 years ago

- Q&A: All About Flooring — Hardwood, Carpeting, Tiling, LaminatePosted: 5 years ago

- Tip: 3 Foolproof Social Media Marketing TipsPosted: 6 years ago

- Tips for Hosting a Stress-Free Holiday DinnerPosted: 6 years ago

- Is a Mortgage Refinance Right for You?Posted: 6 years ago

- Check Your Disaster Supplies KitPosted: 6 years ago

- Create an Early Holiday Shopping BudgetPosted: 6 years ago

- 9 Ways to Make Moving Day EasierPosted: 6 years ago

- July 2018 Market Update – Twins Cities RegionPosted: 6 years ago

- Fall Homeowners ChecklistPosted: 6 years ago

- Scam Alert: Spoofed IRS Phone NumbersPosted: 6 years ago

- 15 Years of First Class MortgagePosted: 6 years ago

- How to buy a second homePosted: 6 years ago

- Q&A: Lawn Watering SecretsPosted: 6 years ago

- Troubleshoot Your Air ConditioningPosted: 6 years ago

- Your Mortgage, What to Expect: Clear To ClosePosted: 6 years ago

- Twins Cities Region Monthly Indicators – APRIL 2018Posted: 6 years ago

- Your Mortgage, What to Expect: UnderwritingPosted: 6 years ago

- Your Mortgage, What To Expect: Property AppraisalPosted: 6 years ago

- 3 Tips to Improve your Credit Score and Score a Lower Interest RatePosted: 6 years ago

- Changing Interest Rates Have A High Impact On Purchasing PowerPosted: 6 years ago

- The Myth of Multiple Mortgage Credit InquiriesPosted: 6 years ago

- Things to do BEFORE you buy a home.Posted: 6 years ago

- March Tech Tip: Pack Smarter With PackPointPosted: 6 years ago

- 4 Ways to Pay Off Your Mortgage EarlyPosted: 6 years ago

- Clean House in a HurryPosted: 6 years ago

- Your Mortgage, What To Expect: Document ReviewPosted: 7 years ago

- Chill Winter Utility BillsPosted: 7 years ago

- Six Tips to Help Your Home Sell This FallPosted: 7 years ago

- 4 Things to Know About Closing CostsPosted: 7 years ago

- Understanding Your Credit ScorePosted: 7 years ago

- Equifax Data Breach: What should you do now?Posted: 7 years ago

- Should You Refinance Your FHA to a Conventional Loan?Posted: 7 years ago

- 6 Ways to Save on Paint ProjectsPosted: 7 years ago

- Q&A: Mortgage InsurancePosted: 7 years ago

- How to Keep Your House Cool this SummerPosted: 7 years ago

- Mortgage Education: “What’s the Point?”Posted: 7 years ago

- Q&A: Spotting a Spoof SitePosted: 7 years ago

- Moving ChecklistPosted: 7 years ago

- Squash Marital Money SquabblesPosted: 7 years ago

- April 2017: Twin Cities Real Estate Market UpdatePosted: 7 years ago

- Your Spring Guide to Home StagingPosted: 7 years ago

- March 2017: Twin Cities Real Estate Market UpdatePosted: 7 years ago

- Don’t be a Victim — Four Ways Protect Yourself from Refinance ScamsPosted: 7 years ago

- Local Market Update: Minneapolis Area Association of RealtorsPosted: 7 years ago

- First-Time Homebuyers: Where to startPosted: 7 years ago

- Dear First Class Mortgage:Posted: 7 years ago

- First Class Mortgage. Our Expertise, Your Peace of Mind.Posted: 8 years ago

18

September

Understanding Your Credit Score

Posted byAs you probably know, your credit is an important factor when determining your eligibility for a home loan. It is also a factor that will help determine your interest rate for a home mortgage.

Being “in the know” about your credit is important. One of our experienced Mortgage Consultants can counsel you about your credit score. The first step is to fill out an application. When the application is complete, they can pull credit. This score will allow them to talk you through specifics regarding your loan status eligibility and potential interest rates.

If your credit score is not where it needs to be, one of the First Class Mortgage Consultants can give you steps to take to build your credit. They can also suggest a time frame of when you could potentially check back in and re-evaluate your score and eligibility.

Information to keep you “in the know”:

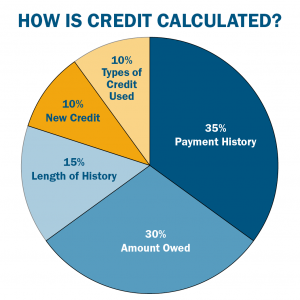

Your FICO credit score takes five things into account. Here is the break-down of those five areas:

• 35% Payment History – payment patterns of debts

• 30% Amount Owed – If what you currently owe is reasonable for your credit profile

• 15% Length of History – The average age of all your accounts

• 10% New Credit – How much new credit you have to your name

• 10% Types of Credit Used – How many types of accounts you have (loans, credit cards, etc.)

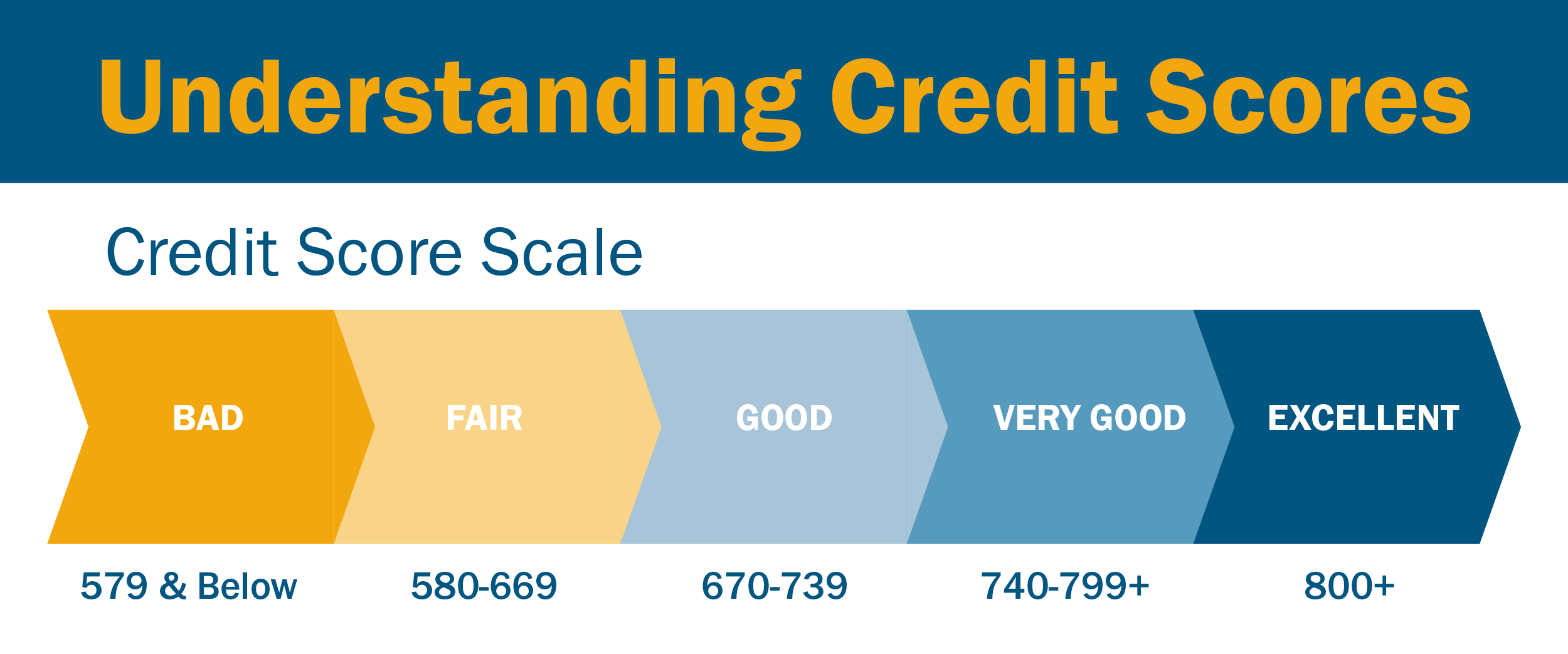

What your score means to lenders:

• Excellent (800 or Higher): Applicants with scores in this range are at the top of the list for the best rates from lenders.

• Very Good (740–799): Applicants with scores here are likely to receive better than average rates from lenders.

• Good (670–739): Only 8% of applicants in this score range are likely to become seriously delinquent in the future.

• Fair (580–669): Applicants with scores in this range are considered to be subprime borrowers.

• Bad (579 & Below): Credit applicants may be required to pay a fee or deposit, and applicants with this rating may not be approved for credit at all.

APPLY TODAY to get started on your pre-approval and credit evaluation.