Recent Posts

categories

Archives

- Tips to Lower your Electric BillPosted: 5 years ago

- 5 Easy Home Improvement Projects & Upgrades For the WinterPosted: 5 years ago

- Benefits to buying in the winterPosted: 5 years ago

- Cash In with a Cash-Out RefinancePosted: 5 years ago

- Mortgage MythsPosted: 5 years ago

- Q&A: All About Flooring — Hardwood, Carpeting, Tiling, LaminatePosted: 5 years ago

- Tip: 3 Foolproof Social Media Marketing TipsPosted: 6 years ago

- Tips for Hosting a Stress-Free Holiday DinnerPosted: 6 years ago

- Is a Mortgage Refinance Right for You?Posted: 6 years ago

- Check Your Disaster Supplies KitPosted: 6 years ago

- Create an Early Holiday Shopping BudgetPosted: 6 years ago

- 9 Ways to Make Moving Day EasierPosted: 6 years ago

- July 2018 Market Update – Twins Cities RegionPosted: 6 years ago

- Fall Homeowners ChecklistPosted: 6 years ago

- Scam Alert: Spoofed IRS Phone NumbersPosted: 6 years ago

- 15 Years of First Class MortgagePosted: 6 years ago

- How to buy a second homePosted: 6 years ago

- Q&A: Lawn Watering SecretsPosted: 6 years ago

- Troubleshoot Your Air ConditioningPosted: 6 years ago

- Your Mortgage, What to Expect: Clear To ClosePosted: 6 years ago

- Twins Cities Region Monthly Indicators – APRIL 2018Posted: 6 years ago

- Your Mortgage, What to Expect: UnderwritingPosted: 6 years ago

- Your Mortgage, What To Expect: Property AppraisalPosted: 6 years ago

- 3 Tips to Improve your Credit Score and Score a Lower Interest RatePosted: 6 years ago

- Changing Interest Rates Have A High Impact On Purchasing PowerPosted: 6 years ago

- The Myth of Multiple Mortgage Credit InquiriesPosted: 6 years ago

- Things to do BEFORE you buy a home.Posted: 6 years ago

- March Tech Tip: Pack Smarter With PackPointPosted: 6 years ago

- 4 Ways to Pay Off Your Mortgage EarlyPosted: 6 years ago

- Clean House in a HurryPosted: 6 years ago

- Your Mortgage, What To Expect: Document ReviewPosted: 7 years ago

- Chill Winter Utility BillsPosted: 7 years ago

- Six Tips to Help Your Home Sell This FallPosted: 7 years ago

- 4 Things to Know About Closing CostsPosted: 7 years ago

- Understanding Your Credit ScorePosted: 7 years ago

- Equifax Data Breach: What should you do now?Posted: 7 years ago

- Should You Refinance Your FHA to a Conventional Loan?Posted: 7 years ago

- 6 Ways to Save on Paint ProjectsPosted: 7 years ago

- Q&A: Mortgage InsurancePosted: 7 years ago

- How to Keep Your House Cool this SummerPosted: 7 years ago

- Mortgage Education: “What’s the Point?”Posted: 7 years ago

- Q&A: Spotting a Spoof SitePosted: 7 years ago

- Moving ChecklistPosted: 7 years ago

- Squash Marital Money SquabblesPosted: 7 years ago

- April 2017: Twin Cities Real Estate Market UpdatePosted: 7 years ago

- Your Spring Guide to Home StagingPosted: 7 years ago

- March 2017: Twin Cities Real Estate Market UpdatePosted: 7 years ago

- Don’t be a Victim — Four Ways Protect Yourself from Refinance ScamsPosted: 7 years ago

- Local Market Update: Minneapolis Area Association of RealtorsPosted: 7 years ago

- First-Time Homebuyers: Where to startPosted: 7 years ago

- Dear First Class Mortgage:Posted: 7 years ago

- First Class Mortgage. Our Expertise, Your Peace of Mind.Posted: 8 years ago

30

April

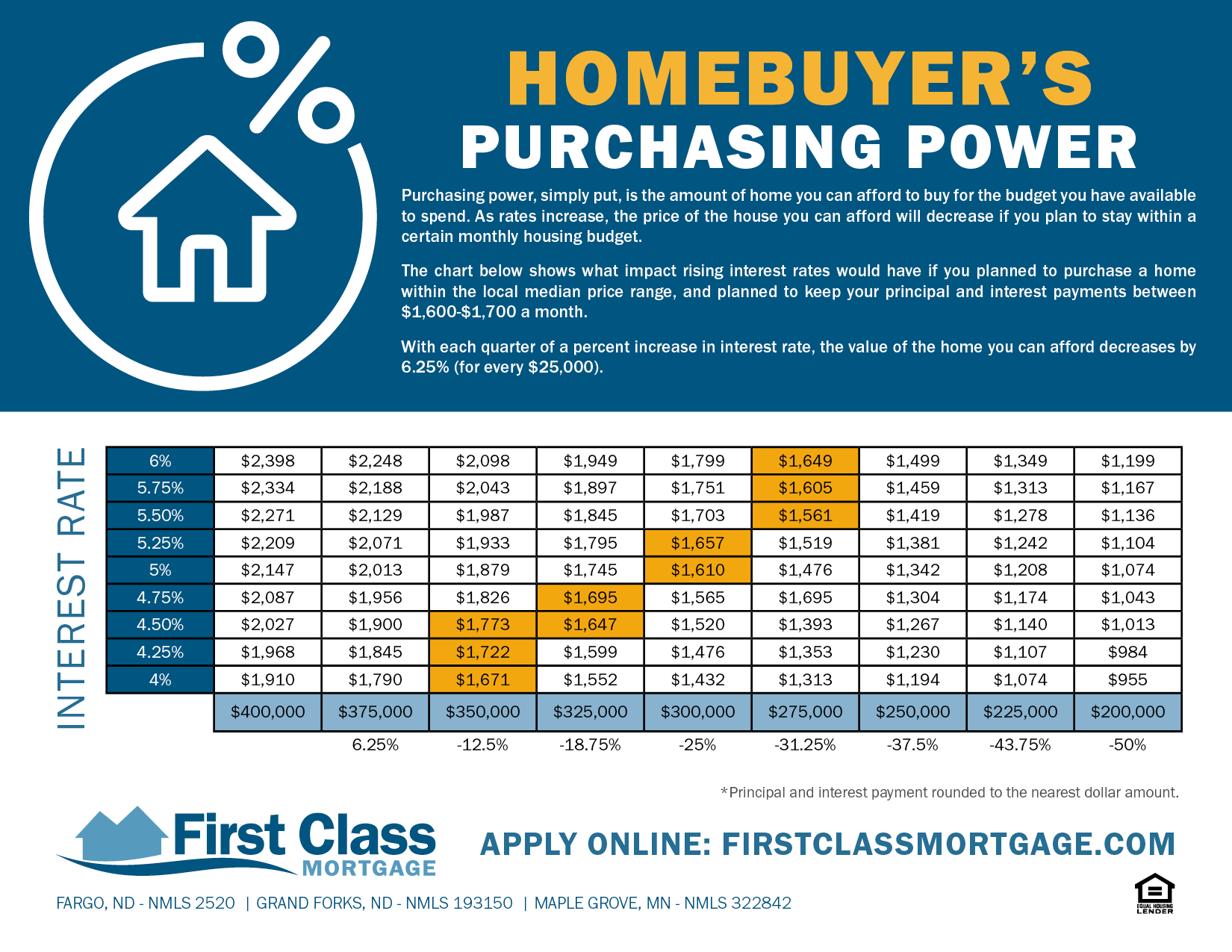

Changing Interest Rates Have A High Impact On Purchasing Power

Posted byPurchasing power, simply put, is the amount of home you can afford to buy with the budget you have available to spend. As rates increase, the price of the house you can afford will decrease if you plan to stay within a particular monthly housing budget.

The chart below shows what impact rising interest rates would have if you planned to purchase a home within the local median price range, and intended to keep your principal and interest payments between $1,600-$1,700 a month.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 6.25% (for every $25,000). DOWNLOAD PRINTABLE FILE