Recent Posts

categories

Archives

- Tips to Lower your Electric BillPosted: 5 years ago

- 5 Easy Home Improvement Projects & Upgrades For the WinterPosted: 5 years ago

- Benefits to buying in the winterPosted: 5 years ago

- Cash In with a Cash-Out RefinancePosted: 5 years ago

- Mortgage MythsPosted: 5 years ago

- Q&A: All About Flooring — Hardwood, Carpeting, Tiling, LaminatePosted: 5 years ago

- Tip: 3 Foolproof Social Media Marketing TipsPosted: 6 years ago

- Tips for Hosting a Stress-Free Holiday DinnerPosted: 6 years ago

- Is a Mortgage Refinance Right for You?Posted: 6 years ago

- Check Your Disaster Supplies KitPosted: 6 years ago

- Create an Early Holiday Shopping BudgetPosted: 6 years ago

- 9 Ways to Make Moving Day EasierPosted: 6 years ago

- July 2018 Market Update – Twins Cities RegionPosted: 6 years ago

- Fall Homeowners ChecklistPosted: 6 years ago

- Scam Alert: Spoofed IRS Phone NumbersPosted: 6 years ago

- 15 Years of First Class MortgagePosted: 6 years ago

- How to buy a second homePosted: 6 years ago

- Q&A: Lawn Watering SecretsPosted: 6 years ago

- Troubleshoot Your Air ConditioningPosted: 6 years ago

- Your Mortgage, What to Expect: Clear To ClosePosted: 6 years ago

- Twins Cities Region Monthly Indicators – APRIL 2018Posted: 6 years ago

- Your Mortgage, What to Expect: UnderwritingPosted: 6 years ago

- Your Mortgage, What To Expect: Property AppraisalPosted: 6 years ago

- 3 Tips to Improve your Credit Score and Score a Lower Interest RatePosted: 6 years ago

- Changing Interest Rates Have A High Impact On Purchasing PowerPosted: 6 years ago

- The Myth of Multiple Mortgage Credit InquiriesPosted: 6 years ago

- Things to do BEFORE you buy a home.Posted: 6 years ago

- March Tech Tip: Pack Smarter With PackPointPosted: 6 years ago

- 4 Ways to Pay Off Your Mortgage EarlyPosted: 6 years ago

- Clean House in a HurryPosted: 6 years ago

- Your Mortgage, What To Expect: Document ReviewPosted: 7 years ago

- Chill Winter Utility BillsPosted: 7 years ago

- Six Tips to Help Your Home Sell This FallPosted: 7 years ago

- 4 Things to Know About Closing CostsPosted: 7 years ago

- Understanding Your Credit ScorePosted: 7 years ago

- Equifax Data Breach: What should you do now?Posted: 7 years ago

- Should You Refinance Your FHA to a Conventional Loan?Posted: 7 years ago

- 6 Ways to Save on Paint ProjectsPosted: 7 years ago

- Q&A: Mortgage InsurancePosted: 7 years ago

- How to Keep Your House Cool this SummerPosted: 7 years ago

- Mortgage Education: “What’s the Point?”Posted: 7 years ago

- Q&A: Spotting a Spoof SitePosted: 7 years ago

- Moving ChecklistPosted: 7 years ago

- Squash Marital Money SquabblesPosted: 7 years ago

- April 2017: Twin Cities Real Estate Market UpdatePosted: 7 years ago

- Your Spring Guide to Home StagingPosted: 7 years ago

- March 2017: Twin Cities Real Estate Market UpdatePosted: 7 years ago

- Don’t be a Victim — Four Ways Protect Yourself from Refinance ScamsPosted: 7 years ago

- Local Market Update: Minneapolis Area Association of RealtorsPosted: 7 years ago

- First-Time Homebuyers: Where to startPosted: 7 years ago

- Dear First Class Mortgage:Posted: 7 years ago

- First Class Mortgage. Our Expertise, Your Peace of Mind.Posted: 8 years ago

24

April

Mortgage Myths

Posted byAre you looking to buy a home this spring, but are worried you don’t have enough for a 20% down payment?

Good news! You can put down less than 20%. In fact, according to the National Association of Realtors, in 2018, 72% of first-time homebuyers made a down payment of 6% or less.

Though the 20% down myth has been around a while, there are several low- and even zero-down-payment loan options on today’s market.

FHA loans, for example, allow for down payments as low as 3.5%, while some conventional loan programs offer down payments of 3-5%. For veterans and military service members, VA loans offer mortgages with zero down payment altogether. Also, if you are considering a home outside of major urban areas, a USDA home loan is a zero down payment mortgage for eligible rural and suburban homebuyers.

Don’t let a misconception about down payments keep you from purchasing a home. Give us a call today to learn more about the variety of loan options or apply online today.

25

May

Your Mortgage, What To Expect: Property Appraisal

Posted byAfter your initial document review has been completed and you have been pre-approved, the next step is a property appraisal.

What is a property appraisal and why is it so important?

A major part of the home sale process is the appraisal. No matter how much a seller wants for his home, or how much a buyer is willing to pay for a home, in the end, it all comes down to the appraisal.

A property appraisal is an unbiased estimate of the true (or fair market) value of what a home is worth. All lenders order an appraisal during the mortgage loan process so that there is an objective way to assess the home’s market value and ensure that the amount of money requested by the borrower is appropriate.

While appraisals can vary by state, there are three main parts to a home appraisal:

- The inspection – A licensed appraiser comes to the property and inspects it to determine a fair market value

- Research on comparables – After the inspection, the appraiser researches similar homes in your area and compares recent sales to determine the market value

- Final appraisal report – using the data gathered from the inspection and comparables research, the appraiser issues a final appraisal report

Several determining factors influence an appraisal:

- The condition of the housing market

- Property location and neighborhoods

- Compared value of similar homes

- Physical condition

- Amenities

- Number of bedrooms and bathrooms

- Age and design

- Overall appearance, interior, and exterior

- Energy efficiency and appliances

Before arriving at a final decision, the appraiser must complete a considerable amount of market analysis, in addition to property specific research. There’s also the need to precisely define the purpose of the appraisal. There are, for example, various types of value — including fair market value, insurance value, tax value and value in use.

Ready to get started? Give us a call or fill out an online application: APPLY ONLINE HERE.

30

April

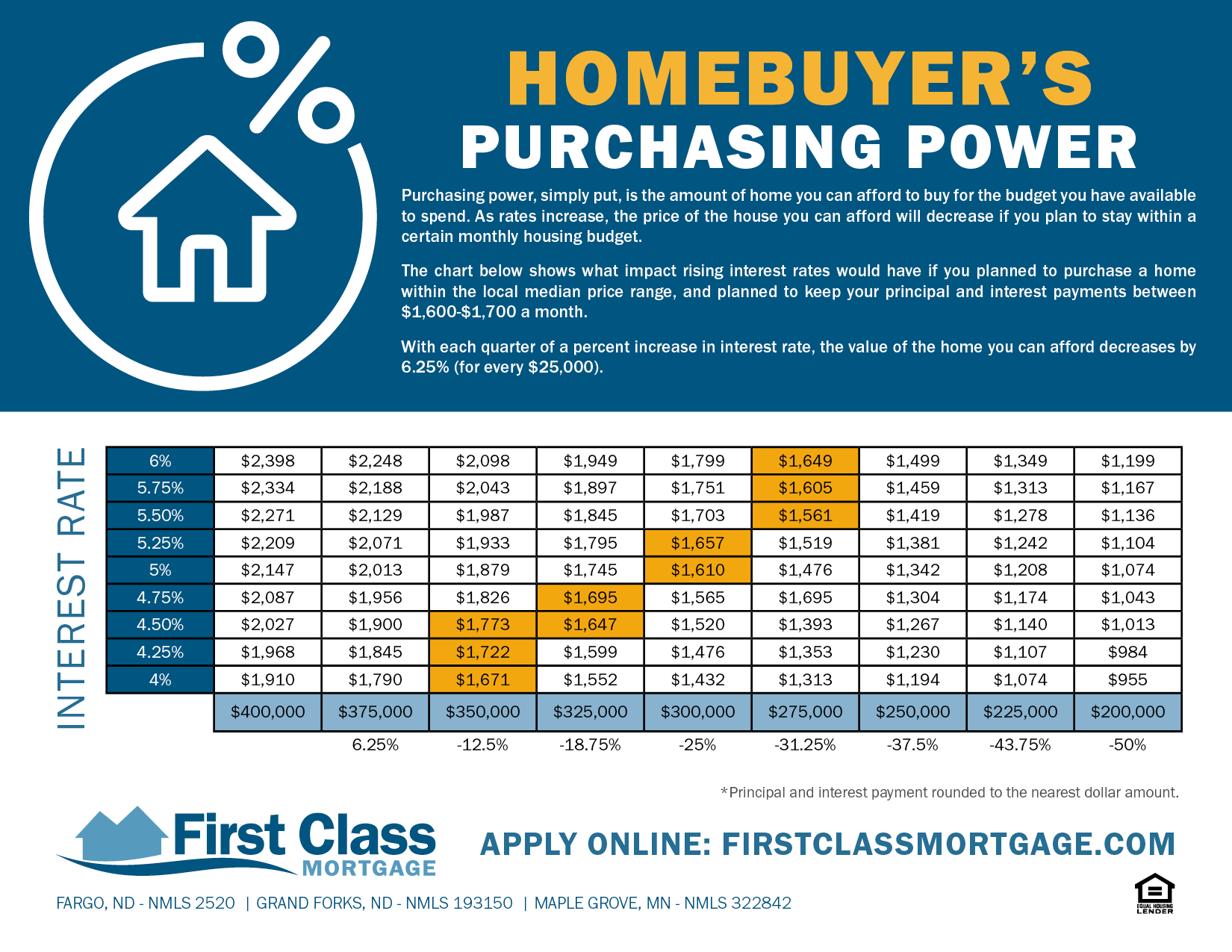

Changing Interest Rates Have A High Impact On Purchasing Power

Posted byPurchasing power, simply put, is the amount of home you can afford to buy with the budget you have available to spend. As rates increase, the price of the house you can afford will decrease if you plan to stay within a particular monthly housing budget.

The chart below shows what impact rising interest rates would have if you planned to purchase a home within the local median price range, and intended to keep your principal and interest payments between $1,600-$1,700 a month.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 6.25% (for every $25,000). DOWNLOAD PRINTABLE FILE

18

April

The Myth of Multiple Mortgage Credit Inquiries

Posted by Don’t let the fear of multiple credit inquiries keep you from shopping for a mortgage.

Don’t let the fear of multiple credit inquiries keep you from shopping for a mortgage.

Fact: Your credit score plays a significant role in your life. Scores can determine insurance rates, employment, opening a bank account, and borrowing money like mortgage lending.

If you would like a refresher course on how your credit scores work, check out our blog post on credit scores.

Applying for too much new credit in a short period of time can adversely affect your hard-earned score. So it is natural to be nervous about shopping for a mortgage. But the major credit bureaus see the value of comparison shopping – and that’s why they cut homebuyers some slack.

Types of Credit Inquiries

Credit inquiries are broken down into two main groups: hard inquiries and soft inquiries. “Hard inquiries” may affect a credit score, while “soft inquiries” do not affect a score. It is important to understand the difference when applying for new credit.

Soft inquiries (also known as “soft pulls”) typically occur when a person or company pull your credit as part of a background check. Since soft inquiries are not an application for new credit, they won’t affect your credit scores.

Hard inquiries (also known as “hard pulls”) occur when a financial institution, such as a lender or credit card issuer, checks your credit when making a lending decision. Your mortgage consultant will need to take a look at your credit report to complete your pre-approval you to purchase a home. Granting a lender permission to pull your scores – constitutes a hard inquiry and can lower your credit.

The good news is the “hit” to your credit is typically just 3-5 points.

Shop Multiple Lenders, Get One “Ding” On Your Credit Report

The important concept is that — unlike applying for multiple credit cards — when someone applies for several mortgages, they won’t get “dinged” for multiple, consumer-initiated inquiries. This is because when they apply for five credit cards, they’ll likely get the option to use them all five. By contrast, with the mortgage applications, they’ll only get approved once.

As such, the credit bureaus have made it a formal policy to permit “rate shopping.” In fact, it’s encouraged.

Borrowers have the right to shop with as many lenders as they like. The secret though is for a client to do their shopping for a mortgage within a limited 14-45-day time frame. If you time the inquiries correctly, the credit bureaus will acknowledge the first credit pull as a “ding” — remember, only 3-5 points — but will ignore each subsequent check.

No matter how many credit checks you do, the mortgage inquiries will always get lumped into a single credit score “hit.”

So, happy shopping! We would love a chance to work with you. To get started, give us a call or apply online today!

Sources: myFICO.com, www.consumerfinance.gov

02

April

Things to do BEFORE you buy a home.

Posted byWhether it is your first home or you’re already a homeowner, there are some critical thing you should do before a move to a new place. Here are 13 things that will help make your next move easier.

- Know your credit score. Your score

- Get pre-approved by a local mortgage broker before shopping

- Know every expense beyond the mortgage – insurance, repairs, association fees, property tax, etc.

- Work with a skilled real estate agent that knows your area.

- Understand the actual value of any property you are buying

- Verify all the information in the listing

- Use a reputable home inspector

- Make sure all renovations are up to code

- Understand any Home Owners Association that you will be part of

- Look for water-related problems

- Have a professional look for the presence of asbestos, mold, and radon.

- Make sure the electrical system is up to par

- Know the potential growth of your investment